Examples of Initiatives

Innovating for a Brighter Society

Enhancing customer contact points and supporting new added-value creation driven by data utilization with altcircle

Social issues in the background

- Shortage of digital talent necessary for promoting a digital shift

- Delayed response to utilization of digital data

- Growing information gap among consumers attributed to digital literacy levels

Value provided to society

- Promotion of digital shift in society and among companies

- Creation of new added value driven by data utilization

- Realization of appropriate communication mindful of diverse users

Amid the acceleration of DX and digitalization within society and corporations, increasing contact points with customers, and overwhelming amounts of data, the use of data and enhancement of customer contact points is critical for companies to boost competitiveness. However, the use of data poses various challenges, including response to ever-changing technological trends, shortage of talent for data utilization, and difficulty of measuring the effects.

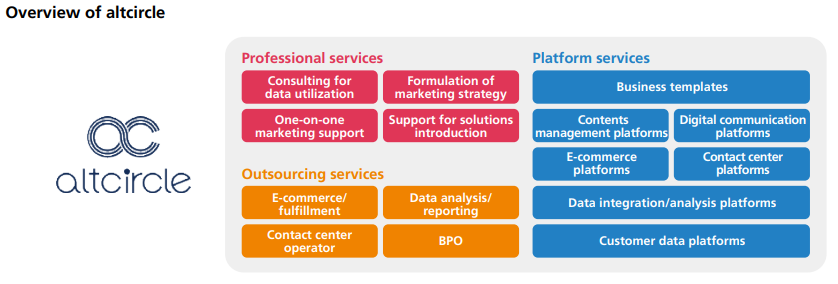

SCSK offers altcircle, a solution for delivering the best possible customer experience (CX) through the enhancement of constantly evolving contact points between corporations and customers. This solution features the following four characteristics.

(1) Constantly evolving platform:The features of platform services, including digital marketing, digital communication and e-commerce, will always be updated based on future technological trends and market needs. In addition to the easy-to-use UI design, clients are also benefited from the efficient and effective support required for optimal communication.

(2) Consulting support for data utilization:We provide one-stop services for various issues occurring in each step of data collection, aggregation and integration, data analysis and visualization and data utilization, which support data utilization and data-driven decision making.

(3) One-on-one business support service:Even in operations, a team with professional skills collaborates closely with clients to support business target attainment.

(4) One-stop service including outsourcing:Comprehensive supports are available for clients who need to build contact center platforms, outsource businesses, develop logistics required of e-commerce businesses, or upload contents to e-commerce websites. By providing clients with high quality, personalized data for data utilization through altcircle, SCSK strives to enhance customer contact points and provide the best possible customer experiences together with new value, contributing to the creation of a comfortable and enriching future.

Launched the Telematics Accident Detection Service

Social issues in the background

- High occurrence of automobile accidents (traffic accidents involving the elderly drivers, road rage, and reckless driving)

Value provided to society

- Mitigation and prevention of traffic accidents

- Prompt and more appropriate handling of accidents

At present, an increase in the number of automobile accidents involving elderly drivers, road rage, and reckless driving has become a social issue in Japan. Also, with the popularization of connected cars and self-driving cars soon to become a reality, the automobile business environment is undergoing drastic changes.

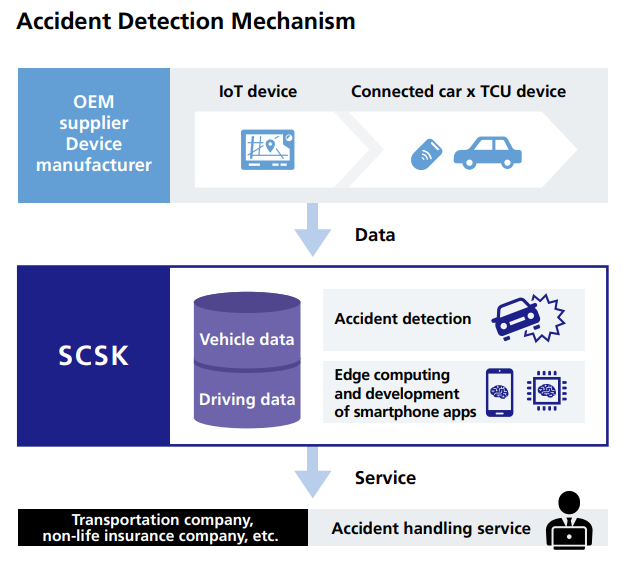

At SCSK, we developed an accident detection algorithm utilizing our unique solution ,the SCSK Neural Network (SNN) toolkit, and further enhanced accident detection within the Telematics*1 Damage Service System, a new accident response service offered by Aioi Nissay Dowa Insurance using its cutting-edge technology as a pioneer of the industry.

The Telematics Damage Service System revolutionizes the style of communication from the conventional passive communication, where insured customers have to contact their insurance company upon an accident, to active communication, where the insurance company reaches out to customers upon detecting a large impact based on various digital data received from the vehicle and devices. We aim to provide peace of mind to clients by achieving prompt and more appropriate handling of accidents.

The SCSK Group will work with clients and partners in creating new businesses and services that society needs, which will help to develop a future society with greater affluence and comfort.

- *1 Telematics is a term coined by combining telecommunication with informatics, and refers to the system of providing various information and services using a mobile communication system and in-car devices such as car navigation and GSP.

Resolving Personnel Shortages Using AI

Social issues in the background

- Labor shortage in call center industry (hiring difficulties and high turnover rate)

Value provided to society

- Enhance operator morale/satisfaction and improve customer engagement by utilizing advanced skills, etc

We provide “PrimeAgent,” our own AI-powered question and answer system. Using this system, customer requests are interpreted and answered using a mascot character online, making it possible for customers to easily find the information they are searching for. This system helps clients to resolve personnel shortages, streamline operations and improve service quality by reducing the call rate at call centers.

Supporting Automobile Design for a Brighter Future

Social issues in the background

- Enviromental issues such as exhaust gas detoxification and reduction of CO2 emissions

- Safety and security such as traffic accident prevention and mobility for an aging society

Value provided to society

- Provide high-quality automotive systems to reduce environmental impacts and realize a safe and secure automotive society

Harnessing our more than three decades of knowledge and know-how in the development of automotive systems, in 2015 SCSK began providing “QINeS,” basic software (BSW) made in Japan compliant with AUTOSAR. SCSK also offers one-stop services for providing BSW engineering tools and management support tools, building optimal processes and supporting education, QINeS introduction and application development, contributing to the development of high quality and high efficiency automotive systems.

Building Trust for a Safe and Secure Society

SASE solutions swiftly provide clients with a business continuity environment during the COVID-19 pandemic

Social issues in the background

- Swift response to need for remote work during the COVID-19 pandemic

- Growing security threats posed by the sheer breadth of devices in use and sharp increase in remote work

- Declining performance due to rapid increase in data center workload

Value provided to society

- Prompt development of environment for sustaining business activities

- Provision of high level security based on zero trust architecture

- Mitigation of workload through cloud-based security network services

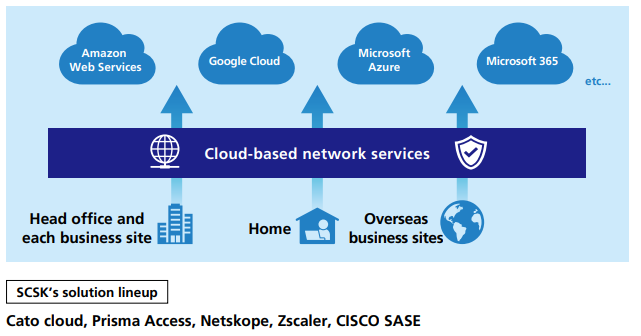

Conceptual Diagram of SASE

In response to the COVID-19 pandemic, nations around the world enacted a number of countermeasures to stop the spread of the virus including lockdowns and public health orders to avoid going out, causing major changes in our way of life.

Countless companies quickly introduced telework programs and systems in order to prevent employee infections while sustaining their business operations amidst this unprecedented situation.

Meanwhile, the workload placed on data centers, communication lines and network security devices increased due to the accelerated migration of operating systems and data once housed internally to the cloud, causing reduced operational efficiency of employees. Additionally, various issues materialized, including security threats posed by the spread of mobile devices and sheer breadth of devices in use along with finding ways to control these risks.

In such an environment, there has been growing interest in zero trust architecture because of its high affinity with cloud services that allows employees to work at any time, from anywhere and with peace of mind.

A zero trust architecture is based on the assumption of not trusting any source and only allowing users and devices with appropriate authentication to access approved applications or data. SCSK uses Secure Access Service Edge (SASE) solutions, a framework for providing network and security services based on zero trust architecture in a seamless manner on the cloud. This reduces network load and quickly provides a stable and secure network environment to clients with various working styles.

At SCSK, we provide the most optimal SASE solutions based on our wealth of knowledge, track record and trusted technological prowess; thereby supporting the corporate activities of clients and contributing to a safe and secure society.

BankSavior® Series Integrated AML Platform

Social issues in the background

- Increased number of financial crimes that are becoming more sophisticated and complex

- Increased cost due to enhanced measures to prevent financial crimes

Value provided to society

- Prevention of financial crimes

- Reliable financial services

Financial crimes such as money laundering, terrorist financing, remittance fraud and other communication fraud are becoming more sophisticated and complex by the day and is a major social issue.

It cases tremendous burden on financial institutions because of the costs associated with enhancing measures to prevent financial crimes and paperwork in response to more strict regulations imposed by the authorities.

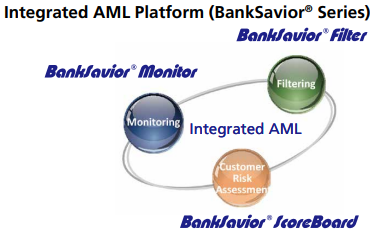

To support early detection and prevention of financial fraud SCSK offers the BankSavior® Series as an integrated AML platform. The BankSavior® Series consists of three major functions.

1. Monitoring (BankSavior® Monitor): a function that monitors daily transactions and supports a series of operations from detection of suspicious transactions to reporting.

2. Filtering (BankSavior® Filter): a function that collates with multiple lists at once, including anti-social forces, targets of economic sanctions, government affiliates of each country, and politically exposed persons (PEPs).

3. Customer risk assessment (BankSavior® ScoreBoard): a function that centrally manages customer information and conducts an anti-money laundering (AML) risk assessment for each customer based on their attributes and transaction information.

The risk assessment computed by BankSavior ® ScoreBoard is automatically relayed to the BankSavior® Monitor to be utilized in monitoring.

Due to financial crimes are becoming more sophisticated and complex, coordination between the three functions of the BankSavior ® Series will reduce the operational burdens of financial institutions as well as achieve a higher standard in AML management.

Through providing BankSavior® Series, we aim to preventfinancial crimes and achieve reliable financial services, thereby contributing to a safe and secure society.

Developing Cyber Security Professionals

Social issues in the background

- Rising costs to combat increasing cyber crime (cyber attacks, illegal access, and information leakages,etc.)

- Increasing social unease

Value provided to society

- Reduce the possibility of security crime/incidents and provide more reliable and secure information platforms

Developing engineers capable of understanding and addressing the latest security threats will ensure the integrity of various systems used by companies and organizations. Recognizing the shortage today, SCSK is working to develop cyber security professionals in an organized and systematic manner. Human resources developed according to a specialized career path are playing an active role in the secure operations of clients’ systems and our own data centers.

Creating an Inclusive Society

Asset Formation Lounge Efukuri, a platform for workplace asset formation delivering peace of mind and easing money concerns of company employees

Social issues in the background

- Distortion of social security system due to declining birthrate and aging population

- Delayed response to asset formation due to a lack of financial literacy

Value provided to society

- Promotion of future asset formation through increased financial literacy

- Provision of life support tailored to individual needs

With social security and pension plans facing various challenges due to Japan’s aging population, there is growing importance of personal asset formation among individuals in order to sustain an active role in the era of the 100-year life. Amidst this, more and more employees working at companies want to design a life plan including retirement based on detailed money simulations and receive optimized support during life events because it is difficult to accurately grasp how much income they will have before and after retirement and how much they will spend depending on their life plan. There is also a growing demand among companies to provide an employee benefits program that enables their people to lead a good life, including asset formation support.

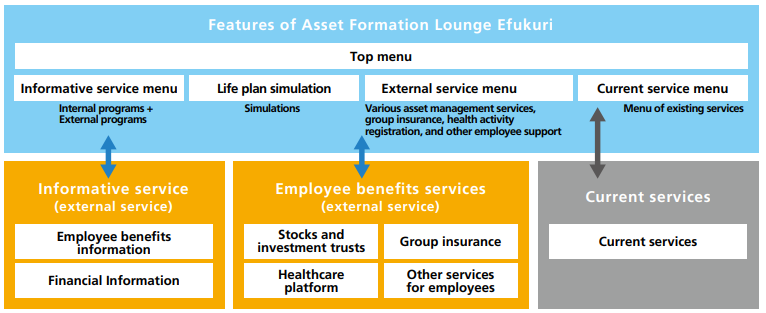

SCSK offers Asset Formation Lounge Efukuri as a service in response to these two distinct needs.

Efukuri supports asset formation closely in tune with future life plans. It uses life plan simulations based on personnel system, retirement benefits and pension plan to visualize a person’s income and spending in detail, and provide useful financial knowledge that helps to increase financial literacy.

Based on the results of life plan simulations and detailed records of service, Efukuri recommends various external services tailored to an individual’s own preferences, including nursing care, healthcare, childcare, education, and ceremonial occasions such as marriage. This makes it possible to support various life events in a timely and comprehensive manner. In addition to these services, Efukuri centrally manages scattered benefits information and company rules for different life events to provide services related to employee benefits in a one-stop fashion.

Through Efukuri, SCSK seeks to support the asset formation of company employees and ease their concerns about money. At the same time, through tailored lifestyle services, we deliver peace of mind and certainty toward the future, contributing to an inclusive society where people can play an active role.

Services provided by Asset Formation Lounge Efukuri

Financial Brokerage Platform (Japanese version of TAMP*1 ) that supports asset management advice for individuals from financial brokers

Social issues in the background

- Necessity for asset formation for post-retirement as a result of increased average life expectancy

- Distortion of social security system due to declining birthrate and aging population

Value provided to society

- Asset design for the era of the 100-year-life. Promotion of turning savings into assets.

- Supporting IFAs*2 to provide asset management services in a more sophisticated and efficient way

While Japan’s social security system is faced with various challenges due to the declining birthrate and aging population, as exemplified by the issue of retiring with less than ¥20 million, it is becoming more important to have one's own asset design in place in preparation for the era of the 100-year-life. In Japan, over half of household financial assets are in cash and deposits, and as such, it is crucial to promote the switch from savings to asset formation in order to grow assets over the medium to long-term. To do so, the existence of IFAs who support individual asset formation from a position that is independent of financial institutions is becoming more important.

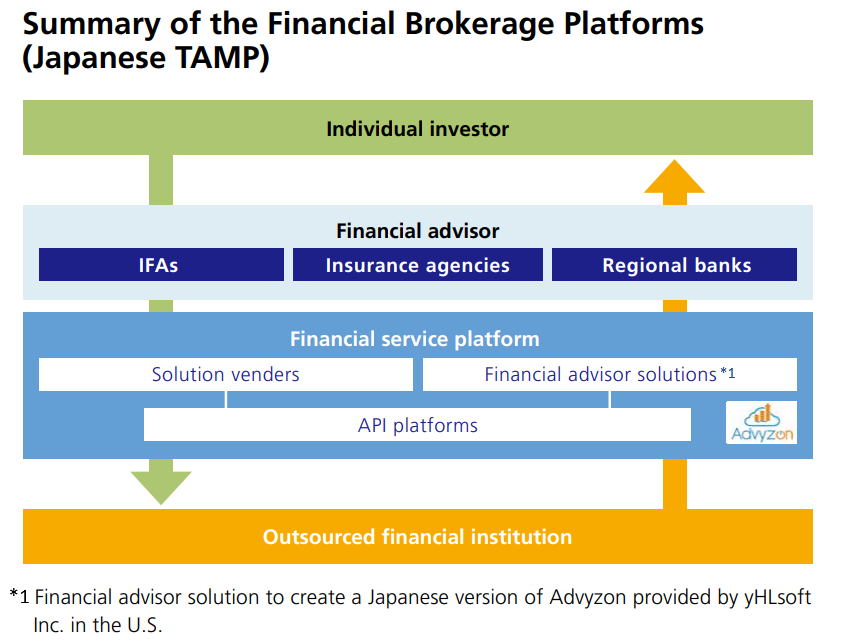

As IFAs are able to purchase and sell various financial products independent of financial institutions, they excel at making proposals tailored to each client’s perspective. On the other hand, there is a lack of solutions that enable comprehensive management of various financial assets for individuals, as well as difficulty to streamline collaboration with multiple financial institutions.

In order to address these challenges, SCSK provides the Financial Brokerage Platform (Japanese version of TAMP) that supports the business of financial brokers. The platform strives to support IFAs to provide services in a more sophisticated and efficient way through its CRM-based solution capable of managing individual financial asset data, and API solution that connects IFAs to financial institutions.

Through our TAMP business, we aim to contribute to a more active society by supporting the promotion of turning savings into assets and contributing to the ample asset design for the era of the 100-year-life.

- *1 TAMP: Turnkey Asset Management Platform

- *2 IFAs: Independent Financial Advisors

Enhancing Productivity and Competitiveness in the Manufacturing Industry

Social issues in the background

- Response to advancements in digitalization, such as AI/loT, and dramatic changes in Industrial structure

- Shortage of labor at manufacturing sites

Value provided to society

- Improve frontline strengths and productivity and create new added value in the manufacturing industry

The PROACTIVE Production helps to quickly build systems which can adapt to changing environments and harness each company’s strengths with templates of necessary operational functions for the manufacturing industry based on our long-standing know-how. Furthermore, we offer additional original, program-less functions using high-speed development tools to deliver production management systems in sync with operations at a lower cost and shorter turnaround time. This powerful assistance toward improving the production site positions SCSK to help increase productivity and enhance competitiveness of the manufacturing industry.

Supporting Streamlined Operations and Work Style Reform with Easy-to-Use Web-Based Systems

Social issues in the background

- Declining population and declining working age population caused by declining birth rate and aging

- Growing criticism of prolonged workin hours (spread of work-life balance)

Value provided to society

- Achieve work style reforms that increase productivity and maintain employee health

We created a simple web-based system enabling companies to streamline intricate calculation work in Excel using a “Do It Yourself” approach. Standardizing, streamlining and automating work increases productivity. The RPA function also contributes to reduced working hours and improved operational quality.