Basic policy

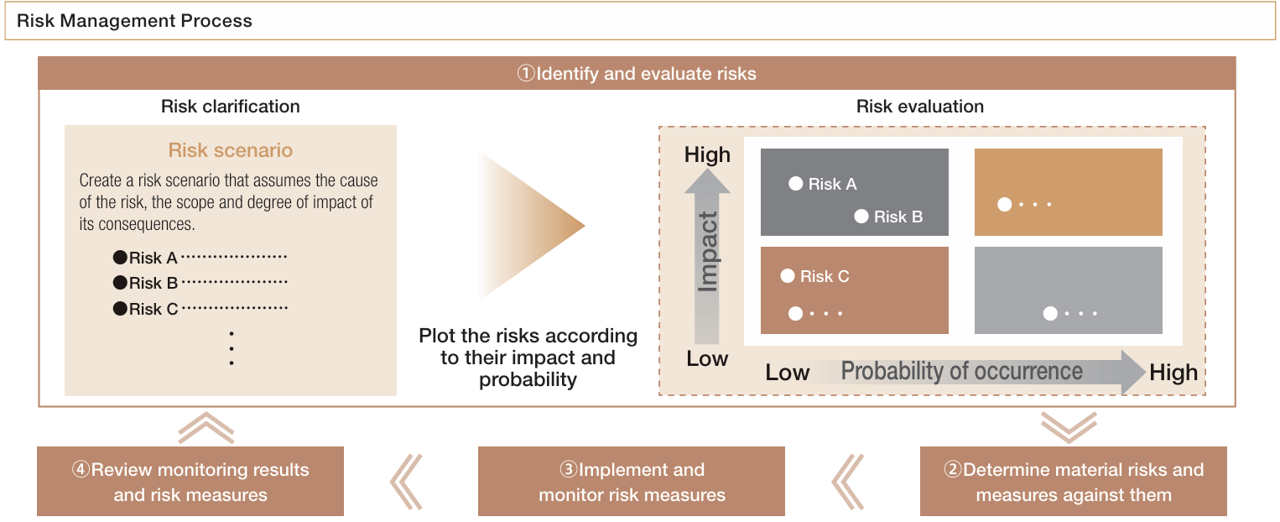

SCSK’s Risk Management Regulations define risk as the possibility of incurring loss and the possibility that returns obtained from business activities fall short of expectations. To ensure the stability of the SCSK Group’s business activities and enhance corporate value, we anticipate various risks to the greatest extent possible during the execution of business activities, and engage in continuous risk management centered on key material risks identified, in accordance with the processes outlined below and for the purposes described to the right.

performance

and growth

corporate

structure

of trust

Risk management system

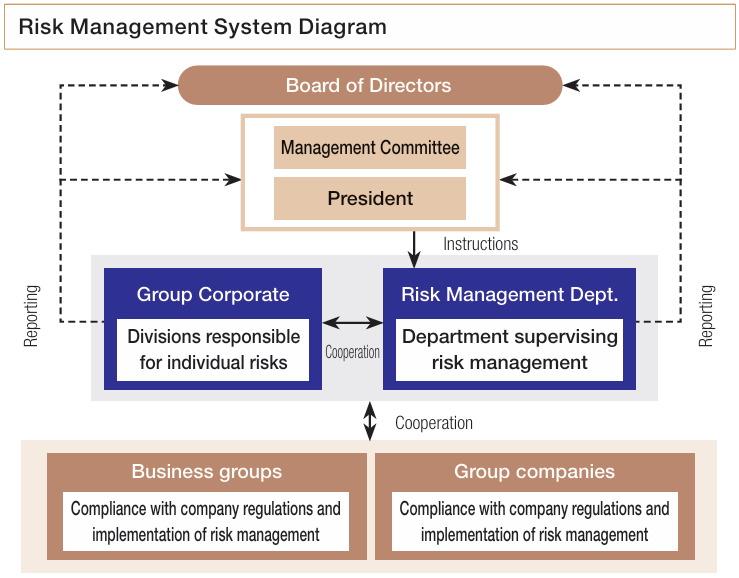

To appropriately manage risks that could have a serious impact on the SCSK Group’s business, SCSK has established internal regulations on risk management and designated the Risk Management Dept. as the central unit responsible for overseeing Group-wide risk management. To ensure the proper functioning of risk management activities, the Risk Management Dept. centrally monitors and evaluates the status of risk management from a Group-wide perspective. In cooperation with Group Corporate and committees responsible for material risks, the department regularly reports the situation to the President and the Management Committee, thereby contributing to the enhancement of risk management quality. The overall status of these activities is also reported to the Board of Directors. By providing sufficient prior explanation, SCSK strives to enhance the supervisory function of the Board of Directors.

In addition, the SCSK Group is working to strengthen its overall management foundation and stabilize business operations by introducing standardized regulations across Group companies, while taking into account the specific circumstances of each entity. In particular, with respect to Net One Systems Co., Ltd., which became a subsidiary of the Company in December 2024, Net One Systems has formulated a “Recurrence Prevention Plan for Inappropriate Conduct” in response to past misconduct. Based on this plan, Net One Systems has established the Governance and Corporate Culture Advisory Committee and the Risk Management Committee, through which it is advancing initiatives to restore trust. These include fundamental reforms to corporate culture, development of a foundation for fostering corporate culture, enhancement of corporate governance, promotion of the corporate philosophy and code of conduct, implementation of mechanisms to prevent organizational memory loss, and optimization of systems for gathering employee feedback.

The SCSK Group is working to continuously improve its risk management practices through the above activities, in order to effectively respond to changes in the business environment.

Emergency response and business continuity plan

In preparation for unforeseen emergencies that could have a major impact on the SCSK Group, such as major disasters and pandemics, SCSK has established rules of conduct and organizational frameworks. We are implementing a number of advanced measures, centered on the Disaster Risk Management Subcommittee, which is composed of related departments at each office and with the president or office manager serving as the person in charge. These measures include stockpiling food, water, and other supplies, conducting drills with the employee safety confirmation system, conducting training on setting up disaster headquarters, establishing a system to address emergencies that take place at night or on holidays, creating a disaster response website, developing a mutual support system in the event the head office (Tokyo metropolitan area) or other locations are damaged, and information sharing and awareness-raising activities for employees via a disaster countermeasure portal. Furthermore, we are working to ensure the effectiveness of the business continuity plan by conducting annual reviews.

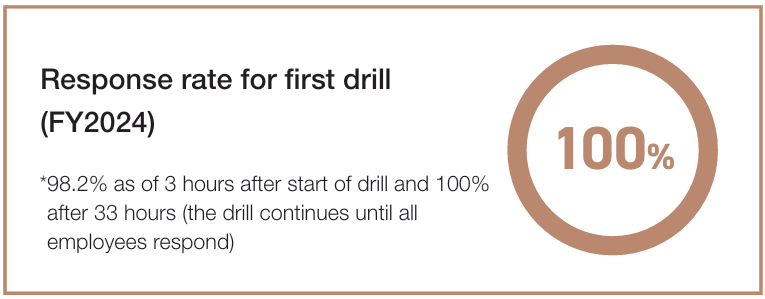

Safety confirmation training

SCSK introduced its employee safety confirmation system, the purpose of which is to confirm and ascertain the safety of employees and their families and damage at the various offices when a disaster occurs and to quickly restore business, in 2011, and conducts regular drills involving all employees.

Initiatives toward household disaster prevention

At SCSK, we are working on not only natural disaster countermeasures for offices but also activities to raise awareness about countermeasures for individual employees’ homes (disaster risk reduction at home) as a growing number of employees are teleworking.

As part of this, we issue a Home Disaster Prevention Manual, and provide e-learning training and seminars to all employees. We are working to create a business continuity system by continuing to implement natural disaster countermeasures at both the office and homes.