Enhancing Information Disclosures and Communication

Basic Policy

Information disclosure represents an important responsibility of management from the standpoint of ensuring the transparency and fairness of the company’s decision making.We strive to carry out information disclosure in an appropriate and timely manner in order to help deepen understanding among various stakeholders, including shareholders and other investors, about decision making by the SCSK Group’s management and its business activities.

The Group’s basic policy on information disclosures is to disclose information in a proactive manner. In addition to disclosures on operating results and financial information pursuant to laws and regulations, non-financial information (including ESG elements concerning governance along with social and environmental issues) deemed material by SCSK is also communicated using various means, including the corporate website and the SCSK Report.

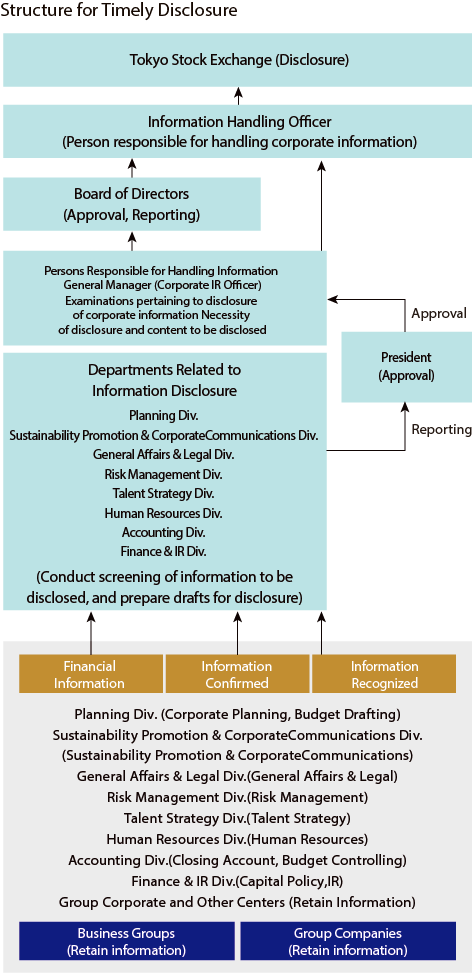

Structure for Timely Disclosure

The SCSK Group recognizes that a high level of management transparency is an important component of corporate governance. Also, as a measure to ensure this transparency, it has established the following system for the disclosure of corporate information. Through this system, we work to disclose information in a timely, appropriate, and fair manner.

- The Planning Div., Sustainability Promotion & Corporate Communications Div., General Affairs & Legal Div., Risk Management Div., Talent Strategy Div., Human Resources Div., Accounting Div., and Finance & IR Div. properly gather information that is subject to disclosure, screen what is to be disclosed, and prepare drafts for disclosure.

- Upon receiving authorization from the President, the information handling officers—the person responsible for supervising the management and disclosure of information—confirm the content and determine whether disclosure is required.

- The information handling officers appropriately disclose corporate information after receiving approval from the Board of Directors when necessary.

Communication with Shareholders and Other Investors

The SCSK Group actively holds constructive communication with shareholders and other investors in order to contribute to sustainable growth and the enhancement of medium- to long-term corporate value. Through transparent information disclosure and honest communication, we have them deepen the understanding of the Company, and utilize opinions received in management to enhance corporate value.

In order to promote the constructive communication with shareholders and investors, a system has been established mainly by the Corporate IR Officer and Investor Relations Dept., in which Representative Director, Outside Directors, and heads of business divisions, etc. directly talk especially with analysts, fund managers, and persons in charge of ESG. With the aim of disclosing information on the SCSK Group’s business activities in an appropriate and timely manner, we have enhanced internal systems for information gathering and coordination, and thereby realized high-quality IR activities.

In more than 300 individual interviews and group meetings held in FY2024, we had opportunities to communicate with a total of approx.700 analysts and investors from Japan and overseas. Putting emphasis on dialogue with overseas investors, we actively participated in investment conferences which securities firms held for overseas institutional investors, and also hold IR meetings overseas.

As an initiative to promote dialogues, we hold quarterly financial results conferences (with a total of approx.400 participants). In September 2025, we held a briefing session on the business integration with Net One Systems Co., Ltd. Moreover, we have conducted proactive IR activities, for example, continuously holding briefings for individual investors to deepen understanding about the SCSK Group’s operations.

Opinions received through these dialogues are reported to the Board of Directors and the management team by the Corporate IR Officer in a timely and appropriate manner, and are utilized in formulating management strategies and improving IR activities. For example, in formulating the Medium-Term Management Plan, we referred to opinions from shareholders and investors regarding growth strategies and capital policies. Going forward, we will continue to place importance on dialogues with stakeholders and reflect them in management toward an enhancement of corporate value.

Main Dialogue Themes in FY2024

- Market environment for IT services

- Performance trends

- Progress of the Medium-Term Management Plan

- Financial and non-financial strategies

- Initiatives regarding ESG

- Integration plan and synergies with Net One Systems Co., Ltd.