SCSK is working to ensure transparency in management, strengthen appropriate governance and monitoring structures, and enhance the soundness of management through ongoing risk management.

Basic Approach and System for Corporate Governance

Embracing its focus on corporate social responsibility, the SCSK Group implements sustainability management with an eye to shareholders and other stakeholders.

From this perspective, the SCSK Group considers raising the efficiency and soundness of management as well as ensuring transparency in the decision-making process as the most basic components of its corporate governance. Rating these matters high among management priorities, we aim to build an optimal management structure that benefits SCSK the most.

We implement each of the principles set forth in the Tokyo Stock Exchange’s Corporate Governance Code and provide detailed disclosures within our Corporate Governance Report based on each principle.

Overview of Corporate Governance System (as of June 24, 2025)

| Institutional design | Company with Audit and Supervisory Committee |

|---|---|

| Directors | 11 (of which 6 are Independent Outside Directors) |

| Chairman of the Board | Masaki Nakajima (Chairman and Director, Non-executive director) |

| Audit and Supervisory Committee Members | 4 (of which 3 are Independent Outside Directors) |

| Term of Directors stipulated in Articles of Incorporation | Directors who are not Audit and Supervisory Committee Members: 1 year Directors who are Audit and Supervisory Committee Members: 2 years |

| Executive Officer system | Adopt |

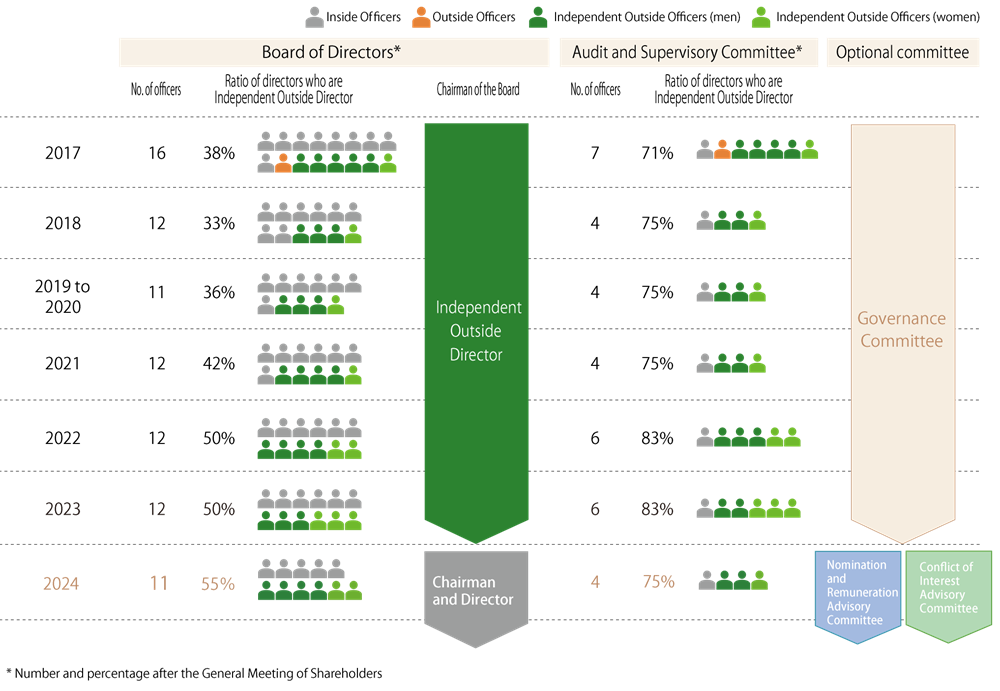

History of Efforts to Strengthen Corporate Governance(until 2025)

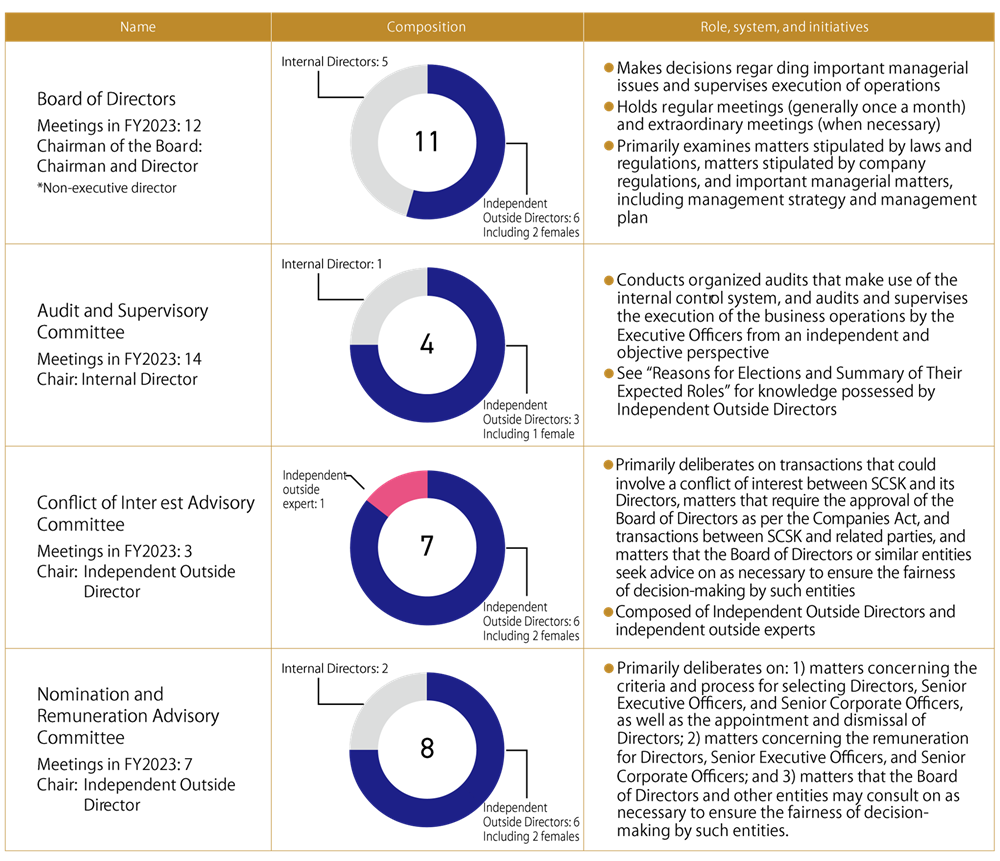

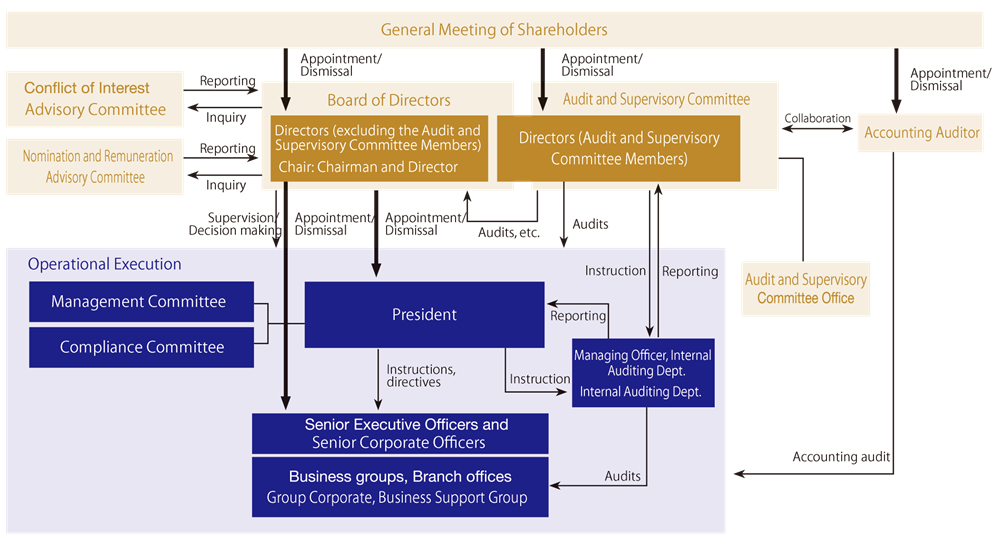

Corporate Governance Structure

| Name | Role, system, and initiatives |

|---|---|

| (5) Senior Executive Officers and Senior Corporate Officers |

|

| (6) Management Committee |

|

| (7) Internal Auditing Dept. |

|

Corporate Governance Structure

Composition of Board of Directors and Committees

◎:Chairperson ○:Committee Member ( ):Attendance record*1

| Position | Name | Board of Directors | Audit and Supervisory Committee | ||

|---|---|---|---|---|---|

| Conflict of Interest Advisory Committee*4 | Nomination and Remuneration Advisory Committee | ||||

| Chairman and Director | Masaki Nakajima*3 | ◎ (2/2 meetings)*6 |

− | − | ○ |

| Representative Director President and Chief Operating Officer |

Takaaki Touma | (13/13 meetings) | − | − | ○ |

| Director Executive Vice President |

Takafumi Takeshita*3 | (−) | − | − | − |

| Director | Shinichi Kato | (11/11 meetings) | − | − | − |

| Director*2 | Tetsuya Kubo | (13/13 meetings) | − | ○ | ◎ |

| Director*2 | Sadayo Hirata | (13/13 meetings) | (3/3 meetings)*5 | ○ | ○ |

| Director*2 | Shoei Yamana | (11/11 meetings) | − | ○ | ○ |

| Director (Audit and Supervisory Committee Member) | Hiromichi Jitsuno | (13/13 meetings) | ◎ (15/15 meetings) |

− | − |

| Director (Audit and Supervisory Committee Member)*2 | Yasuo Miki | (13/13 meetings) | (15/15 meetings) | ○ | ○ |

| Director (Audit and Supervisory Committee Member)*2 | Hidetaka Matsuishi | (13/13 meetings) | (15/15 meetings) | ○ | ○ |

| Director (Audit and Supervisory Committee Member)*2 | Yumiko Waseda | (13/13 meetings) | (15/15 meetings) | ◎ | ○ |

*1 Attendance records from April 2024 to March 2025

*2 Outside Director

*3 Newly elected(from June 2025)

*4 In addition one independent outside expert (lawyer) has been appointed as a committee member, bringing the total number of committee members to 7.

*5 Ms. Hirata was a Director (member of the Audit and Supervisory Committee) from June 2022 until the conclusion of the Annual General Meeting of Shareholders in June 2024, and was appointed as a Director (excluding Audit and Supervisory Committee member) at the Annual General Meeting of Shareholders in June 2024.

*6 For Mr. Masaki Nakajima, his attendance at Board of Directors meetings until June 19, 2024, during which he served as a Director of the Company, is shown.

Significance of Parent-and-Subsidiary Listing and Policy to Protect Minority Shareholders

Significance of parent-and-subsidiary listing

●We will work closely with our parent company, Sumitomo Corporation, to support and enhance the execution of its global business by building and operating its IT platform, and to create global businesses in areas such as digital transformation (DX) and open innovation. We will thus be able to acquire new business opportunities and business partners, to share business strategies with Sumitomo Corporation, and to leverage each other’s strengths, which will in turn enhance each other’s corporate value.

●There are several advantages for SCSK to be a listed company. These include the establishment of a solid financial base with the increased ability to raise funds, the enhanced credibility through the establishment and operation of a governance structure with transparency in corporate management and an internal control system, the enhanced corporate name recognition and brand power in recruiting personnel, the enhanced credibility with its clients, the enhanced reliability of its services, and the improved motivation of its officers and employees.

Policy on the Protection of Minority Shareholders

●At SCSK, Independent Outside Directors constitute the majority of the Board of Directors. In addition, to ensure fairness and transparency while appropriately considering the shared interests of the Company and its shareholders, two advisory committees have been established under the Board: the Conflict of Interest Advisory Committee, composed solely of Independent Directors and external experts, and the Nomination and Remuneration Advisory Committee, in which six of the eight members are Independent Directors.

- (1) The Conflict of Interest Advisory Committee deliberates on transactions with the parent company that are deemed significant to ensure that minority shareholders are not disadvantaged, and submits its recommendations to the Board of Directors.

- (2) The Nomination and Remuneration Advisory Committee deliberates on matters such as the criteria and process for selecting Directors, Senior Executive Officers, and Senior Corporate Officers; the appointment and dismissal of these officers; and the remuneration for Directors, Senior Executive Officers, and Senior Corporate Officers. The Committee submits its recommendations to the Board of Directors.

For details of each committee, please refer to the above.

In addition, with respect to the exercise of voting rights by the parent company regarding the appointment and dismissal of Independent Directors of the Company, it has been confirmed that such decisions are made based on the reasons for the proposal of candidates nominated by the Company.

Furthermore, on the premise that the independence of the Company's decision-making is ensured, the Company consults or reports to the parent company in advance regarding important business executions that may have a significant impact on the corporate value of the parent company group.

Appointment and Dismissal of Directors and Procedures

When appointing and dismissing Directors (excluding those who are Audit and Supervisory Committee Members), the Nomination and Remuneration Advisory Committee is consulted, and the appointment and dismissal is tabled at the General Meeting of Shareholders after being resolved by the Board of Directors taking into consideration the opinion of the Audit and Supervisory Committee. In addition, for candidates for Directors who are Audit and Supervisory Committee Members, the approval of the Audit and Supervisory Committee is obtained, and then they are appointed or dismissed through the same process.

As for the composition and number of Board of Directors members, decisions are made taking into consideration the skills that should be possessed by the SCSK's Board of Directors and the balance and diversity of skills possessed by each Director.

To maintain and improve Directors' supervision of execution of duties, Independent Outside Director about whom there are no concerns of conflict of interest with general shareholders will continue to be selected. Outside Directors who possess management judgement based on a wide range of business activities attend Board of Directors meetings and provide advice to maximize corporate value.

- ●Possess knowledge, experience, and track record required of SCSK Directors

- ●Can constructively participate in deliberations at Board of Directors meetings

- ●Possess outstanding management skills and insight into thoroughly adhering to laws, regulations, and corporate ethics

- ●For Directors who also serve as executive officers, possess extensive knowledge in responsible fields

- ●Possess specialized insight and experience as Director who is an Audit and Supervisory Committee Member and can conduct audits from an objective perspective

- ●In addition to the above, possess specialized and broad insights into corporate management and various fields

Reasons for Elections and Summary of Their Expected Roles

| Outside Director | Reasons for Elections and Summary of Their Expected Roles | |

|---|---|---|

| Tetsuya Kubo (Chair of the Nomination and Remuneration Advisory Committee) |

Independent Director |

Mr. Tetsuya Kubo possesses robust management experience gained over years of serving in important positions at major financial institutions as well as wide-ranging knowledge pertaining to global businesses. We believe that the experience and insights that he has acquired through his career qualify him to help maintain and enhance the supervision of execution of operations at SCSK and to offer advice on all areas of management, and we have thus selected him as an Outside Director. |

| Sadayo Hirata | Independent Director |

Ms. Sadayo Hirata has a wealth of experience as an engineer as well as academic insight pertaining to IT and technology management. We believe that the experience and insights that she has acquired through her career qualify her to help maintain and enhance the supervision of execution of operations at SCSK and to offer advice on all areas of management, and we have thus selected her as an Outside Director. |

| Shoei Yamana | Independent Director |

Mr. Shoei Yamana possesses robust management experience and wide-ranging knowledge of the environment, society, and human rights obtained through his long career at senior positions at a major precision equipment company. We believe that the experience and insights that he has acquired through his career qualify him to help maintain and enhance the supervision of execution of operations at SCSK and to offer advice on all areas of management, and we have thus selected him as an Outside Director. |

| Yasuo Miki | Audit and Supervisory Committee Member, Independent Director |

Mr. Yasuo Miki possesses a breadth of experience in managing IT companies as well as wide-ranging technology knowledge. He was selected as an Outside Director who is an Audit and Supervisory Committee Member because we believe the experience and insights he has acquired through his career qualify him to help maintain and enhance supervision of execution of operations at SCSK and to provide advice on overall management. |

| Hidetaka Matsuishi | Audit and Supervisory Committee Member, Independent Director |

Mr. Hidetaka Matsuishi possesses robust management experience and wide-ranging knowledge of marketing, finance, and accounting obtained through his long career at senior positions at a major electric instruments company. He was selected as an Outside Director who is an Audit and Supervisory Committee Member because we believe the experience and insights he has acquired through his career qualify him to help maintain and enhance supervision of execution of operations at SCSK and to provide advice on overall management. |

| Yumiko Waseda (Chair of the Conflict of Interest Advisory Committee) |

Audit and Supervisory Committee Member, Independent Director |

Ms. Yumiko Waseda possesses specialized knowledge and experience as an attorney and wide-ranging insight into environmental, social, and human rights issues. She was selected as an Outside Director who is an Audit and Supervisory Committee Member because we believe the experience and insights she has acquired through her career qualify her to help maintain and enhance supervision of execution of operations at SCSK and to provide advice on overall management. |

Skills required of the Board of Directors

The Company decides the size of its Board of Directors and its membership based on consideration of the diversity and balance of the skills of members. To assist in this process, the following list has been prepared of the skills deemed necessary in order to ensure that the Board of Directors is equipped with the knowledge, experience, and capacities required to advance the SCSK Group’s growth strategies.

| Skill | Display Name | Reason for Selection |

|---|---|---|

| Corporate management experience | Corporate management | Corporate management experience is necessary for assessing the opportunities and risks in the Company’s diverse businesses and for guiding investments to help ensure ongoing growth. SCSK is promoting sustainability management as a growth strategy, meaning that it must position the resolution of various social issues as an earnings opportunity and actively contribute to the resolution of these issues. Corporate management experience is imperative for making appropriate management resource investment and other management decisions for this purpose. |

| Financial and accounting expertise and experience | Finance/accounting | Financial and accounting expertise and experience are crucial for accessing business growth potential and profitability in pursuit of high capital efficiency and for practicing timely and appropriate disclosure and highly transparent corporate governance. |

| Technological expertise, foresight, and experience | Technology | Technological expertise, foresight, and experience are needed for making appropriate management decisions pertaining to the introduction of technologies in various fields for use in resolving corporate and social issues. |

| Organization and human resource management expertise and experience | Organization/human resources | Organization and human resource management expertise and experience are required to ensure that the Company can offer opportunities and organizations in which professionals with diverse skills and backgrounds can share a common set of values and grow and succeed while exercising their individuality and expertise. |

| Expertise and experience pertaining to market and economic environments and trends | Marketing | Expertise and experience pertaining to market and economic environments and trends are necessary to identify the issues that may emerge from social or economic changes and to guide the appropriate development and provision of solutions for addressing these issues. |

| Expertise and experience pertaining to environmental, social, and human rights issues | Environmental/social/human rights | Expertise and experience pertaining to environmental, social, and human rights issues are imperative to accurately assessing social issues related to global warming, human rights, regional disparities, and other factors and to identifying the areas in which SCSK can contribute to the resolution of such issues. These skills are also vital to enabling SCSK to develop sound value chains and fulfill other social responsibilities. |

| Legal and risk management expertise and experience | Legal/risk management | Legal and risk management expertise and experience are required to ensure strict compliance and highly effective oversight of management as well as to the development and implementation of appropriate management systems for risks and other matters. |

| Global business expertise and experience | Global | Global business expertise and experience are vital to the Company's efforts to capitalize on the growth opportunities presented by global digitization trends. |

Skills Possessed by Each Director (Skills Matrix)

| Name | Position | Corporate management |

Finance/ accounting |

Technology | Organization/ human resources |

Marketing | Environmental/ social/ human rights |

Legal/ risk management |

Global |

|---|---|---|---|---|---|---|---|---|---|

| Masaki Nakajima | Chairman and Director | ● | ● | ● | ● | ||||

| Takaaki Touma | Representative Director President | ● | ● | ● | ● | ||||

| Takafumi Takeshita | Director Executive Vice President | ● | ● | ● | ● | ||||

| Shinichi Kato | Director | ● | ● | ● | ● | ||||

| Tetsuya Kubo | Outside Director | ● | ● | ● | ● | ||||

| Sadayo Hirata | Outside Director | ● | ● | ● | |||||

| Shoei Yamana | Outside Director | ● | ● | ● | ● | ||||

| Hiromichi Jitsuno | Director (Audit and Supervisory Committee Member) | ● | |||||||

| Yasuo Miki | Outside Director (Audit and Supervisory Committee Member) | ● | ● | ||||||

| Hidetaka Matsuishi | Outside Director (Audit and Supervisory Committee Member) | ● | ● | ● | ● | ||||

| Yumiko Waseda | Outside Director (Audit and Supervisory Committee Member) | ● | ● |

※ With regard to Director Skills mentioned above, of skills required of the Board of Directors, up to four skills that each Director possesses and are especially helpful have been identified. They do not represent all experience and knowledge possessed by each Director

Stimulating Deliberation at the Board of Directors Meetings

We strive to ensure that discussions at the Board of Directors meetings are lively and substantive by enhancing the materials for the meetings, providing advance explanations to Outside Directors, providing information about SCSK’s businesses, and offering opportunities for the exchange of opinions and site visits. As a result of these initiatives, the evaluation of the effectiveness of the Board of Directors has recognized that open and constructive discussions are being conducted.

Additionally, the secretariat determines the annual schedule and deliberation matters of the Board of Directors after providing prior explanations at the Board meetings, continuously reviews agenda standards, and carefully selects matters requiring resolution of the Board of Directors. In this manner, sufficient time is secured for deliberations on truly material matters.

Key matters deliberated by the Board of Directors (April 2024–March 2025)

| 2024 | 2025 | Main discussion items | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Apr. | May | Jun. | Jul. | Aug. | Sep. | Oct. | Nov. | Dec. | Jan. | Feb. | Mar. | ||

| Board of Directors | 〇 | 〇 | 〇 | 〇 | Not held | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |

| Corporate governance |

〇 | 〇 | 〇 | 〇 | 〇 | 〇 |

|

||||||

| Sustainability | 〇 | 〇 | 〇 | 〇 |

|

||||||||

| Operational execution status | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 |

|

|

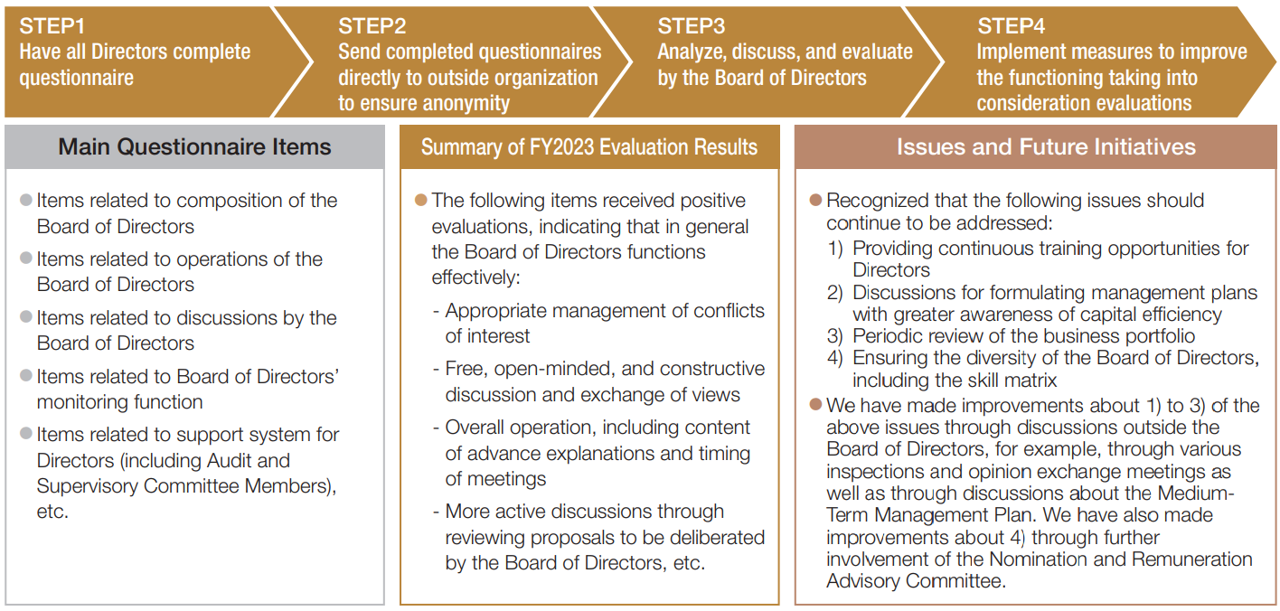

Evaluating the Effectiveness of the Board of Directors(As for the FY2024)

Evaluating the effectiveness of the Board of Directors

Every year, SCSK carries out self-evaluation and analysis concerning the effectiveness of the Board of Directors since FY2016 in order to improve the functions of the Board of Directors and enhance corporate value as a result.

Looking ahead, taking into account the results of this evaluation, SCSK’s Board of Directors will swiftly address the issues identified based on a thorough review and will continue to promote measures for enhancing the functions of the Board of Directors.

Evaluation method

As for the FY2024 self-evaluation and analysis, we conducted a questionnaire survey in February 2025 of all Directors who were Board of Directors Members, receiving advice from an outside organization.

Anonymity was ensured by having Directors submit completed questionnaires to the outside organization. After receiving a report on the results from the outside organization, an analysis, discussion, and evaluation were conducted at the Board of Directors meeting held in May 2025.

Evaluation/Analysis Process

Support and Training Systems for the Board of Directors

Outside Director Support System

Information such as materials and discussion summaries from management meetings, as well as analyst reports, is shared with Outside Directors in a timely manner. In addition, materials for Board of Directors’ agenda items are sent in advance, and opportunities are provided for prior explanations and Q&A sessions by the relevant departments to support effective deliberations at Board meetings.

For Outside Directors who are Audit and Supervisory Committee Members, support is provided through the Audit & Supervisory Committee Office, including the collection and provision of internal information and assistance with various investigations, to facilitate the smooth execution of audit-related duties.

Providing Training Opportunities for Directors

Both when and after taking up their position, Directors are provided with continuous opportunities—such as seminars, business briefings by each business group, and site visits—to acquire the knowledge necessary for fulfilling their roles and responsibilities in SCSK Group corporate management.

In FY2025, seminars were held on a variety of topics, including DE&I, IT industry trends, and corporate governance, based on the increasingly important roles expected of Outside Directors. In addition, specifically to deepen Outside Directors’ understanding of the businesses, business briefings were conducted by each business group and major subsidiaries. A site visit was also organized to SCSK HOKKAIDO CORPORATION, a Group subsidiary, including an observation of smart agriculture initiatives undertaken by its business partner, Hokuren Federation of Agricultural Cooperatives.

Remuneration for Directors

Basic policy on remuneration for Directors and procedures for deciding amount of remuneration

SCSK pays out annual remuneration to Directors including performance-linked compensation, within the maximum amount as determined at the Ordinary General Meeting of Shareholders.

Policies and procedures for determining the content of remuneration, etc. for Directors, calculation methods, and levels of remuneration for Directors are deliberated by the Nomination and Remuneration Advisory Committee, the majority of members of which are Independent Outside Directors, and resolved by the Board of Directors.

Remuneration for Directors who are Audit and Supervisory Committee Members is determined through discussion among Directors who are Audit and Supervisory Committee Members pursuant to the provisions of Article 361, Paragraph 3 of the Companies Act.

Remuneration for Directors in FY2024

| Category | Total remuneration (millions of yen) |

Remuneration by type (millions of yen) | Number of people | ||

|---|---|---|---|---|---|

| Fixed compensation (cash) |

Short-term performance-linked compensation (cash) |

Medium- to long-term performance-linked compensation (stock-based) |

|||

| Directors (excluding Directors who are Audit and Supervisory Committee Members) | 313 | 181 | 58 | 74 | 9 |

| (of whom, Independent Outside Director) | (31) | (31) | (—) | (—) | (3) |

| Directors who are Audit and Supervisory Committee Members | 66 | 66 | 0 | — | 6 |

| (of whom, Independent Outside Director) | (43) | (43) | (—) | (—) | (5) |

Basic policies on remuneration for Executive Directors

Remuneration for Executive Directors is positioned as an important matter of corporate governance, and is determined in accordance with the following policies.

- Establish a remuneration system that is aligned to realize the corporate philosophy, “Create Our Future of Dreams” and promote sustainability management that contributes to solving social issues.

- Encourage sustainable growth in corporate value and share profits and risks with shareholders.

- Promote the achievement of medium- and long-term management plans and short-term goals set for such plans.

- Offer competitive remuneration levels to retain talented individuals who will drive sustainable growth.

- Periodically review remuneration levels and composition ratios as appropriate, taking into account the size of the company and benchmarks.

- Ensure that the process for determining remuneration is objective, transparent, and fair to maintain accountability to shareholders, employees, and all other stakeholders.

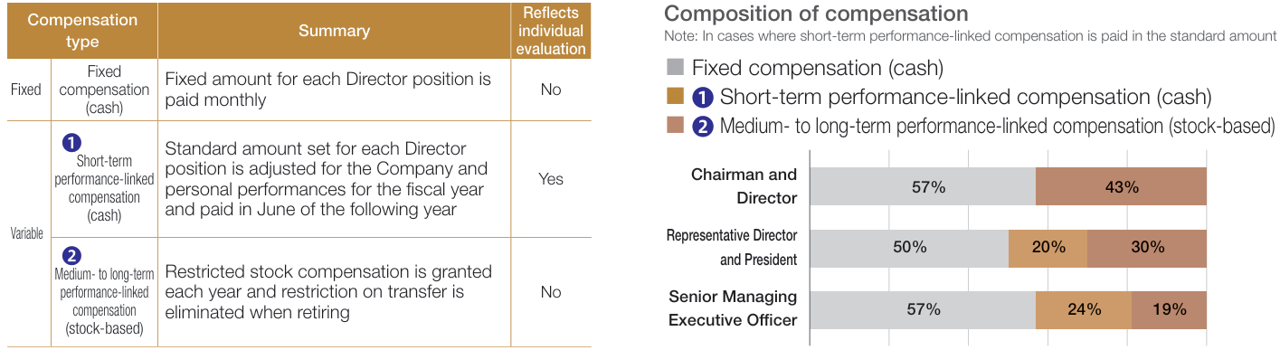

Types, summary, and composition of Director remuneration

Policy and indicators for performance-linked compensation

1Short-term performance-linked compensation (cash compensation)

Ratio of the Company performance portion and the personal performance portion

| Director position | Company performance portion | Personal performance portion |

|---|---|---|

| President and Representative Director | 100% | — |

| Executive Vice President and Director | 60% | 40% |

Short-term performance-linked compensation is calculated by adjusting the standard amount set for each Director position based on the Company and personal performances for the fiscal year and is paid after the fiscal year ends.

The ratio of the Company performance portion and the personal performance portion is 100% and 0% for the President and Representative Director, and 60% and 40% for the Executive Vice President and Director.

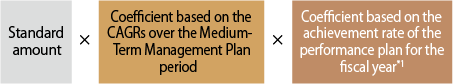

Company performance portion

※1 When obtaining each of the CAGRs and the achievement rate of the fiscal year plan, net sales and operating profit are factored in at a ratio of 30:70

The Company performance portion is calculated by multiplying the standard amount by two coefficients—one is based on the compound annual growth rates(CAGR)※1of net sales and operating profit over the Medium-Term Management Plan period※1while the other is based on the rates of achievement of the net sales and operating profit targets for the fiscal year※1—with the aim of incentivizing the Directors to strive to achieve the Company's sustainable growth and its performance plan. The Company performance coefficients are designed so that they can

cause the standard amount to decrease by up to 75% or increase by up

to 80%.

Personal performance portion

- Selection of and focus on high-potential business domains

- Promotion of Value-Driven Management (sharing of philosophy and vision with employees)

- Environmental, social, and governance initiatives

※2 Personal evaluation items

The personal performance portion is calculated by multiplying the standard amount by the coefficient that reflects the evaluation of each person's accomplishments※2in environmental, social, governance, and other areas, with the aim of enhancing the effectiveness of the managerial foundation reinforcement measures underlying the Medium-Term Management Plan's core strategies. The personal performance coefficient is designed so that it can cause the standard amount to decrease by up to 100% or increase by up to 50%.

2Medium- to long-term performance-linked compensation (stock-based compensation)

Each year, SCSK grants the Directors (excluding Outside Directors, part-time Directors, and Directors who are Audit and Supervisory Committee Members) its common stock as restricted shares after the Ordinary General Meeting of Shareholders, with the aim of incentivizing them to embody the sustained improvement in corporate value depicted in Grand Design 2030 and promoting greater sharing of value with all shareholders.

The restricted transfer period is, in principle, from the day the restricted shares are granted until the day the person resigns from directorship of SCSK, in order to facilitate the sharing of value with shareholders over the medium to long term.

Both Senior Executive Officers and Senior Corporate Officers are also granted restricted shares.

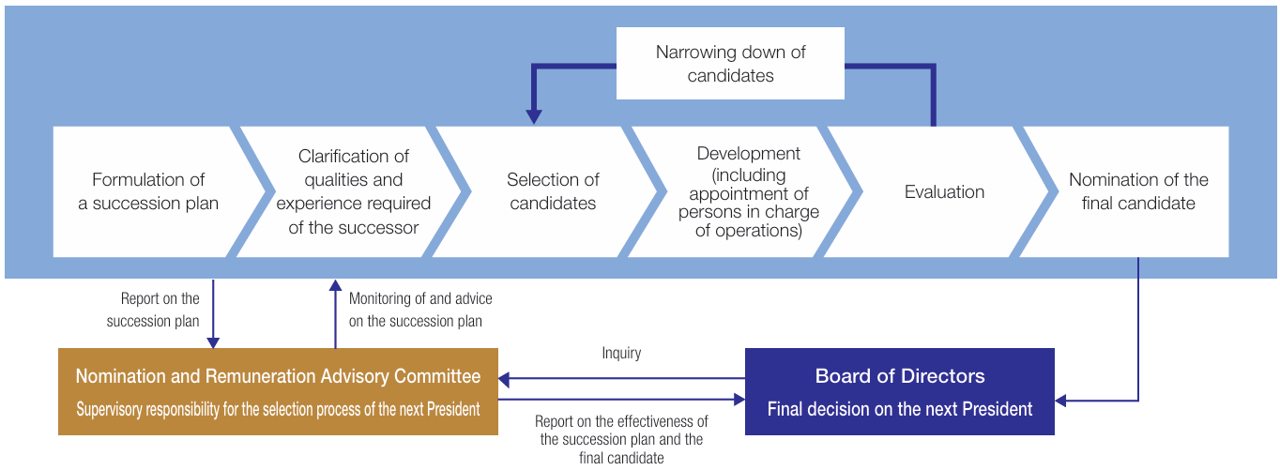

Succession Plan

Succession plan for the President

SCSK has formulated and implemented a succession plan for the President, with the aim of continuously securing corporate managers who will contribute to medium- to long-term growth and improvement of corporate value. In the succession plan, the requirements for successor candidates and the process for selecting them are defined. The selection process emphasizes transparency and fairness, and the Nomination and Remuneration Advisory Committee, the majority of which are Independent Outside Directors, supervises the selection of the final candidate from an objective standpoint. Specifically, the Committee examines the process of selecting successor candidates and provides advice after monitoring whether or not the succession plan, including the development and evaluation of the selected candidates, is effectively executed. The final candidate is selected by resolution of the Board of Directors upon consultation with the Nomination and Remuneration Advisory Committee.

Internal Control

We have established the "Basic Policy for Building the Internal Control System" aimed at achieving the "effectiveness and efficiency of operations," "reliability of reporting," "compliance with laws and regulations related to business activities," and "safeguarding of assets" within the SCSK Group.

The "Basic Policy for Building the Internal Control System" defines the basic policies and necessary measures regarding the system to ensure that the execution of duties by the directors of SCSK complies with laws and regulations, as well as the Articles of Incorporation and the system to ensure the appropriateness of business operations of the SCSK Group. We check the current internal control system and conduct constant reviews, thus building an effective internal control system that meets the needs of the times.

SCSK acquired Net One Systems Co., Ltd. as a subsidiary in December 2024. Net One Systems has a unique internal control framework. The framework includes a Three Lines Model with an additional "1.5th line" functioning as a control tower for internal controls, and is designed to continuously improve a sound corporate culture and organizational climate.

Furthermore, the Governance and Corporate Culture Advisory Committee conducts company-wide and ongoing evaluations and improvements of the effectiveness of the internal control system.